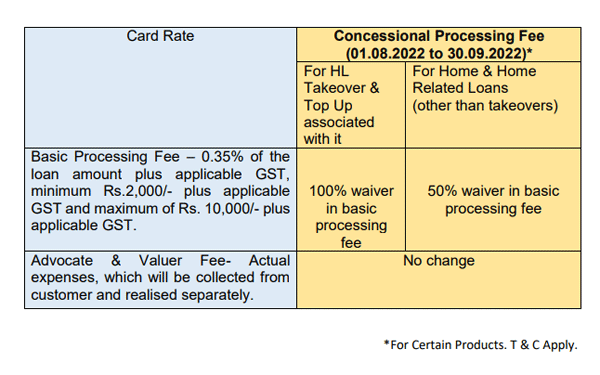

State Bank of India has announced a 50-100% waiver on processing fees on home loans. This offer is valid from August 1, 2022- September 30, 2022.

According to the SBI website, for home & home related loans (other than takeovers), the bank has waived 50% in basic processing fee. For home loan takeover and top up associated with it, the bank has waived 100% in basic processing fee.

There is no change in Advocate and Valuer Fee- Actual expenses, which will be collected from the customer and realised separately.

According to the SBI card rate page on its website, its basic processing fee is 0.35% of the loan amount plus applicable GST, minimum Rs 2,000 plus applicable GST and maximum of Rs. 10,000/- plus applicable GST.

![]()

Artificial Intelligence(AI) Java Programming with ChatGPT: Learn using Generative AI By - Metla Sudha Sekhar, Developer and Lead Instructor View Program

Artificial Intelligence(AI) Basics of Generative AI : Unveiling Tomorrow's Innovations By - Metla Sudha Sekhar, Developer and Lead Instructor View Program

Artificial Intelligence(AI) Generative AI for Dynamic Java Web Applications with ChatGPT By - Metla Sudha Sekhar, Developer and Lead Instructor View Program

Artificial Intelligence(AI) Mastering C++ Fundamentals with Generative AI: A Hands-On By - Metla Sudha Sekhar, Developer and Lead Instructor View Program

Artificial Intelligence(AI) Master in Python Language Quickly Using the ChatGPT Open AI By - Metla Sudha Sekhar, Developer and Lead Instructor View Program

Office Productivity Zero to Hero in Microsoft Excel: Complete Excel guide 2024 By - Metla Sudha Sekhar, Developer and Lead Instructor View Program

Data Science SQL for Data Science along with Data Analytics and Data Visualization By - Metla Sudha Sekhar, Developer and Lead Instructor View Program

Web Development A Comprehensive ASP.NET Core MVC 6 Project Guide for 2024 By - Metla Sudha Sekhar, Developer and Lead Instructor View Program

Office Productivity Mastering Microsoft Office: Word, Excel, PowerPoint, and 365 By - Metla Sudha Sekhar, Developer and Lead Instructor View Program

Marketing Digital marketing - Wordpress Website Development By - Shraddha Somani, Digital Marketing Trainer, Consultant, Strategiest and Subject Matter expert View Program

Finance Financial Literacy - TDS, Budget, Income Tax Act, GST, Indirect tax By - CA Rahul Gupta, CA with 10+ years of domain experience, trainer View Program

Future of Marketing & Branding Masterclass By - Dr. David Aaker, Professor at Haas School of Business View Program

HR & People Management Human Potential and the Future of Employment By - Lynda Gratton, Co-chair of the World Economic Forum Council on Work, Wages and Job Creation, Professor of Management Practice View Program

Strategy ESG and Business Sustainability Strategy By - Vipul Arora, Partner, ESG & Climate Solutions at Sattva Consulting Author I Speaker I Thought Leader View Program

Finance Financial Reporting and Analytics By - Dr. C.P. Gupta, Professor: Department of Finance and Business Economics, University of Delhi View Program

Other charges associated with home loanThere are other fees and charges that apply when you avail home loan. These fees will differ between lenders. Additionally, some lenders may charge fees separately while others may group fees from different lenders together. While some fees are tied as a fixed percentage of the house loan balance, others are not.

Other charges include log in fee, technical assessment fee, legal fee, franking fee, pre-EMI charge, statutory or regulatory charges, re-appraisal fee, insurance premium, notary fee, and adjudication fee.

Latest SBI home loan interest rates

SBI External benchmark linked lending rate: Effective June 15, 2022, the bank’s EBLR is 7.55%+CRP, as per the SBI website. RLLR is 7.15%+CRP. However, depending on the credit score, a risk premium will be charged.

SBI Marginal cost of fund-based lending rates: SBI has raised the marginal cost of fund-based lending rates (MCLR) by up to 0.10 percent with effect from July 15, 2022.

Subscribe to The Economic Times Prime and read the ET ePaper online.

Subscribe to The Economic Times Prime and read the ET ePaper online.

Prime Exclusives Investment IdeasStock Report PlusePaperWealth Edition![]()